Divorce doesn’t

just divide assets.

It shapes your

financial future.

NavigateDivo helps you see the long-term impact

of your financial settlement so you can

advocate for the future you deserve.

How It Works

You complete a guided intake that captures your full financial picture — assets, debts, income, and expenses.

Share Your Numbers

We generate a clean, organized

Marital Estate Snapshot so you can see everything in one place.

Receive Your Snapshot

You tell us the settlement options or key levers you want to explore — we generate comprehensive financial scenarios.

Map the What-Ifs

In a live 45-minute session, we review your snapshot and adjust your model to reflect your current offer or negotiation goals.

Review & Refine Together

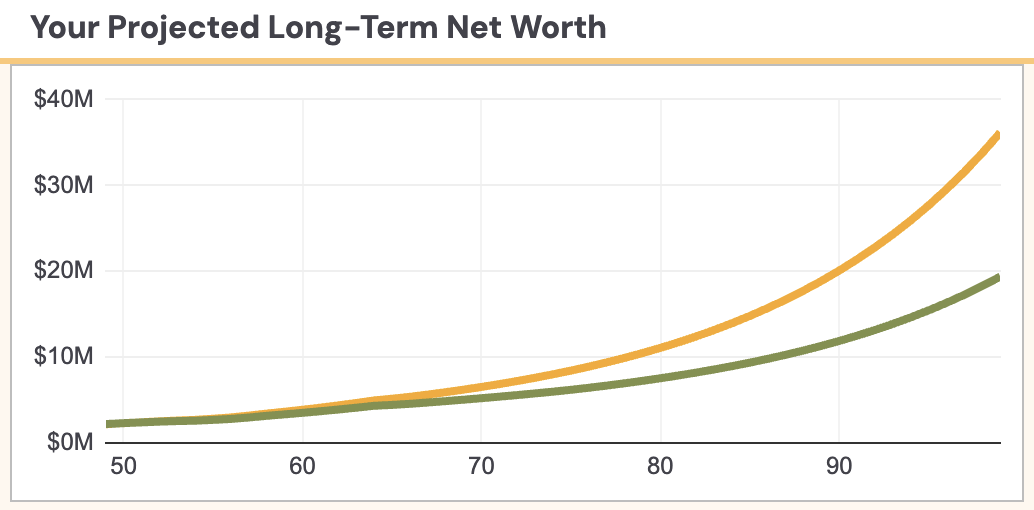

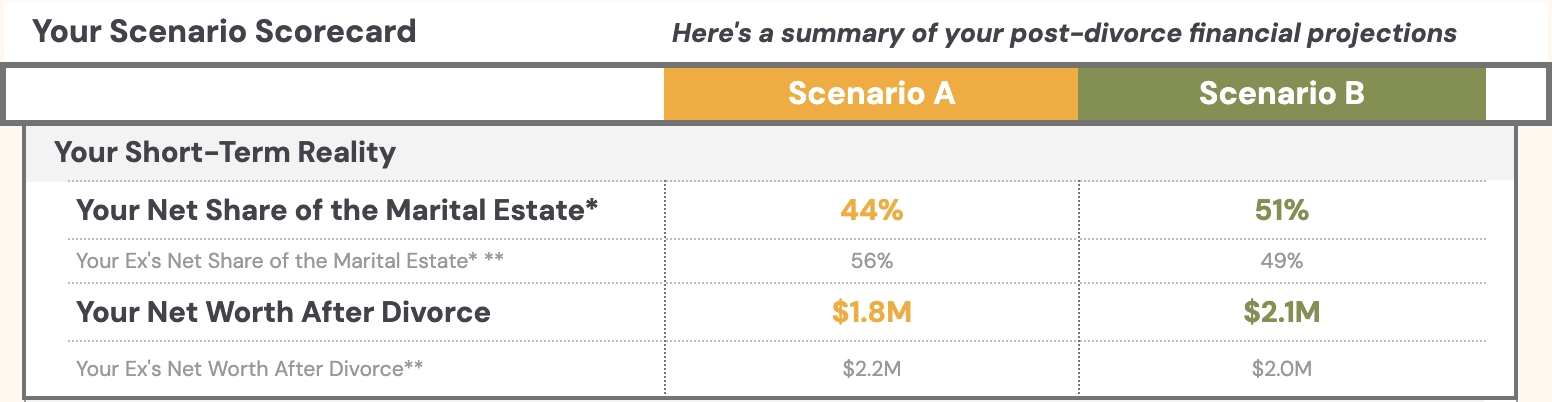

Your Financial Clarity Report compares scenarios side-by-side, helping you see trade-offs and advocate with confidence.

Get Your Clarity Report

You get a complimentary 30-minute adjustment session in case your situation evolves.

Follow-Up Flexibility

NavigateDivo

Models your future.

Simplifies the complex.

Gives you peace of mind.

Don't Guess Your Financial Future

One powerful package to model your marital estate, test scenarios, and gain the confidence to advocate for what’s right.

One-time

$1,095

Your Financial Clarity Report includes:

✔️ Snapshot of your full marital estate

✔️ Side-by-side scenario comparisons

✔️ Scenario summaries with key metrics

✔️ Sensitivity tables for major trade-offs

What’s included in your experience:

✔️ Guided financial intake

✔️ Live review & scenario refinement call

✔️ Bonus scenario adjustment call

✔️ Email support for quick questions

The Clarity Money-Back Guarantee

If you don’t gain a clearer view of your financial future, email us within 14 days and we’ll refund you in full.

No hassle, no questions.

A Personal Mission for Clarity

I’m Benji Fages, CFA—a former Wall Street analyst who’s modeled billions in company value. But the most important model I’ve built wasn’t for a boardroom—it was for people like my parents.

When they divorced, I watched two smart, capable people get yanked around by lawyers, burn through fees, and gamble with six-figure decisions, navigating only with half-clear spreadsheets and no long-term financial view.

I built NavigateDivo so you don’t have to repeat that story. We turn financial chaos into a crystal-clear forecast, helping you see the impact of each decision before you make it. My goal is to give you the clarity and confidence to shape a settlement that fits your future.

— Benji Fages, CFA

Founder, NavigateDivo

What to Know Before You Begin

-

No. Think of our report as a powerful financial map, not a travel guide. We show you the full landscape and project the long-term impact of different paths. You and your expert team decide the best route — but now with the clarity you need to choose wisely.

-

The earlier, the better. Seeing the long-term impact before negotiations begin helps you make better decisions and avoid costly mistakes. Already have an offer? We can still model scenarios so you know exactly what’s at stake before you sign.

-

We store your information in secure, industry-standard tools. It’s never shared outside your project unless you choose to.

-

Yes — and we encourage it. The Financial Clarity Report gives your team a shared, data-driven picture of your finances and scenarios, saving time and billable hours.

-

Yes, as long as you have a current value for them. We can model businesses, pensions, and other complex assets, but we don’t perform valuations. For that, we recommend a specialist.

-

No. Our analysis is based on the data you provide. Uncovering hidden assets is a different service offered by forensic accountants.

-

A spreadsheet can list what you own, but it cannot easily forecast your future. Our proprietary model is pre-built to account for the complex, interconnected variables — taxes, inflation, investment growth, and asset liquidity — giving you a clear, confident forecast without the weeks of work and risk of costly mistakes.